How to Qualify for Low Income Car Insurance: Eligibility Requirements

Driving plays a major role in our daily routine. We use it for different purposes and many individuals find their car as an investment. Car insurance fits right into the picture and proves to be essential for the driver and the passengers in the car. However, with the sudden surge in auto insurance costs, many low income individuals find it difficult to deal with higher auto insurance costs. This makes affordability a challenging task.

You are not alone in this! We can understand the struggle and it is a dilemma to afford comprehensive coverage with limited financial resources. But, don’t lose hope because there are plenty of routes and strategies to explore when it comes to finding affordable insurance.

Worry no more, we are here to guide you through the process of finding low income auto insurance, stating its benefits, and eligibility requirements. We will also learn more about no down payment car insurance. So what are we waiting for, come let’s get your engine started for the safest ride on the road.

How does low income auto insurance work?

By now, you might have grasped the importance of car insurance. If you are living on a budget, car insurance can be an added burden on top of many expenses that you are obliged to meet on a monthly basis. So, you start exploring options that are budget-friendly. One such option is low income auto insurance.

This type of auto insurance is designed to be more affordable to individuals who are not able to pay higher auto insurance costs. Here is how low income auto insurance works:

-

The auto insurance offered to you under this category highly depends upon your income. You need to provide essential documents to prove that your income falls under the low income category.

-

The coverage options offered under the low income auto insurance are usually basic. They might include liability coverage, minimal collision, and comprehensive coverage.

-

These policies are designed to specifically meet the legal requirements of each state while keeping down the costs.

-

Some of these low income auto insurance coverages come with lower upfront costs to no down payment in order to be helpful for individuals with limited savings.

-

In addition to the above information, many states have their own low income auto insurance programs to offer affordable coverage to their residents. These programs also have varied eligibility requirements and coverage options.

State-sponsored government backed programs

Those looking for Low income car insurance have various options. A few states offer government backed programs that allow drivers an opportunity to get the car insurance they need at a price they can afford.

Drivers living in California, Hawaii, and New Jersey have access to state-sponsored car insurance. These programs tend to offer more affordable car insurance options for drivers with low income. Here’s a breakdown of available government-sponsored state programs for drivers with low income.

-

California’s state-funded Low Cost Automobile (CLCA) Insurance Program provides affordable coverage to eligible drivers. It only provides state-minimum liability insurance for the vehicle’s primary driver and one additional driver.

-

Hawaii’s Assistance to the Aged, Blind, and Disabled (AABD) program provides free car insurance and other essential benefits to eligible drivers

-

New Jersey has two low-income car insurance programs. One is The New Jersey Special Automobile Insurance Policy (SAIP). This allows New Jersey residents with low income to secure medical payment coverage if they receive federal Medicaid with hospitalization benefits. Whereas New Jersey’s other low-income program, known as the Basic Policy, only provides a small amount of personal injury protection (PIP) and property damage liability coverage.

Factors that affect eligibility

While the eligibility requirements differ from one state to another, there are several factors that can influence your ability to secure low income auto insurance. Here are some of the factors:

-

Location

As mentioned earlier, the state you live in has a major impact in determining your low income auto insurance rates. This is because insurance regulations can vary across different states. So, ensure that you research your state’s requirements carefully before selecting the insurance companies.

-

Insurance provider

As states have different regulations, the insurance companies also have their own set of eligibility requirements and programs. You might have different options after your research and will come to know that one insurer might have affordable options while others may have stricter requirements.

-

Policy type

You might have come across different types of policies. They have different eligibility requirements. For instance, collision coverage might have different eligibility criteria when compared to liability coverage or personal injury protection. Before selecting your desired policy, make sure that you are receiving enough protection for your vehicle.

-

Driving practices

Irrespective of your income or financial situation, your driving practices play a major role in determining your eligibility. A safer driving record will account for better rates and imposes a sense of responsibility on the driver. Whereas, if you have faced any damages solely because of your driving practices, your eligibility will have an impact.

How can low income individuals access car insurance?

Car insurance is a necessity for individuals who want to protect their vehicles whether it’s stationary or up and running on the road. As you have read till here, you might have this question - “Who exactly can get low income car insurance?” So we are here to break it down for your clarity:

-

Income

The income level is obviously one of the prime determinants. Apart from you being a low income individual, your income must fall under a certain category that is set by your State. Along with this, the insurance companies also calculate your annual earnings and other additional resources you have. Your low income is determined with the help of federal poverty levels.

-

Household and savings

Other factors like household size, assets, and savings also play a crucial role in determining how you can access car insurance as a low-income individual. A single individual with a lower income will have a different eligibility than a family of four to five with the same income level. Here is the logic behind it, larger households will find it difficult to allocate funds for insurance premiums as they have more financial obligations.

Monitoring auto insurance statistics

Auto insurance residents of low-income pay 51.5% higher premiums than residents of high income.

215 million drivers carry car insurance in the U.S.

Over 2.2 million people are injured in motor vehicle crashes in the U.S.

About 2.57% of the average household income is spent on auto insurance.

82% of uninsured drivers can’t afford insurance or don’t have an operable vehicle.

79% of insured drivers buy comprehensive coverage.

75% of insured drivers buy collision coverage.

No down payment car insurance - How to qualify?

If you are confused if a down payment is required or not, we are here to break the ice if a no down payment car insurance is possible or not. To be frank, a no down payment car insurance means that you will be paying not more than or less than the first month’s coverage to start the policy.

Without paying any upfront, it is not possible to start your policy. While the amount you pay upfront might differ and can be more affordable than the regular down payment amounts. To those who are brand new to securing low income auto insurance, we have got you covered with some of the tips to qualify.

-

Good credit - Some insurance companies in these cases, ask for your credit score. A good credit score has a higher chance of helping you qualify for a no down payment car insurance.

-

Good driving record - We can’t stress this enough. If you would like to lock in the best car insurance costs, it is best to maintain a record of safe driving history. It can be beneficial and help you pay lesser upfront costs.

-

Compare and shop - Different insurance providers offer varying policies and payment options, so we recommend you compare quotes and policies to find the best fit for your needs.

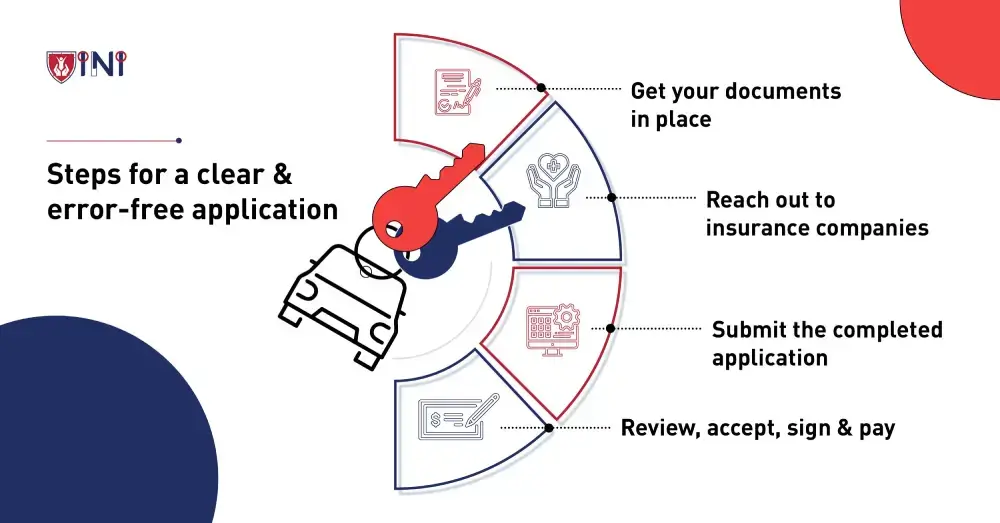

4 Essential steps to apply for a Low Income Auto Insurance

Let's have a quick run-through over the steps that you are required to take in order to apply for low income auto insurance.

-

Gather documents

If you want to prove your case, then you need to have all the documents in place well organized in advance, so you don’t rush at the last minute.

-

Reach out

Take time from your day to reach out to insurance companies that provide low income car insurance. Inquire about the application process and required documents.

You will gain adequate information that you need in order to go ahead with your application.

-

Complete the application

Once you have selected your preferred insurance company, go ahead, follow the steps involved in the application and apply. Make sure you provide accurate information during the submission of your application.

-

Review, accept, and pay

After your application has been processed, review the terms, costs, and coverage. Thoroughly understand the entire policy details before accepting. Once done and signed, you can go ahead and start your premium payments.

Tips to secure affordable car insurance

We value your time for reading up till here. So here you have our bonus. In addition to exploring low income auto insurance options, consider these practical tips for getting affordable car insurance:

-

Bundle policies - We know you have been scratching your head looking for budget-friendly choices. Bundling your policies together is one such option. Combining multiple insurance policies (e.g., auto and home) with the same provider can lead to discounts.

-

Take defensive driving courses - In this course, you will learn safe driving practices and methods to prevent yourself and the passengers from car accidents. Completing this particular driving course may lead to insurance discounts.

-

Review and adjust - If you are looking to reduce your monthly premiums, make sure you assess your coverage needs and adjust your policy annually.

Final notes

We get you! Managing finances effectively during times of commitments and obligations is not easy. If you are still managing and balancing your finances, it is a great thing. But, this situation of yours isn’t permanent. You still have scope for improvement. You can still understand the available options in low income auto insurance programs and get the much needed protection.

We are in a world of options. If one doesn’t work or suit our lifestyle, we can still choose from a pool of other options. For instance, if low income car insurance doesn’t work for you, try out no down payment car insurance. If nothing works out at the end of the day, try improving factors like your credit scores, research and compare ways to deal with monthly premiums.

You are not alone, if you would like to get additional assistance, reach out to Indemnity National Insurance. Our auto insurance specialists will understand your needs clearly and recommend the coverage that suits your needs and budget.

Ride safe with a budget-friendly coverage

Did you find this article helpful? Share it!