8 Tips for Securing the Best Florida RV Insurance Deals

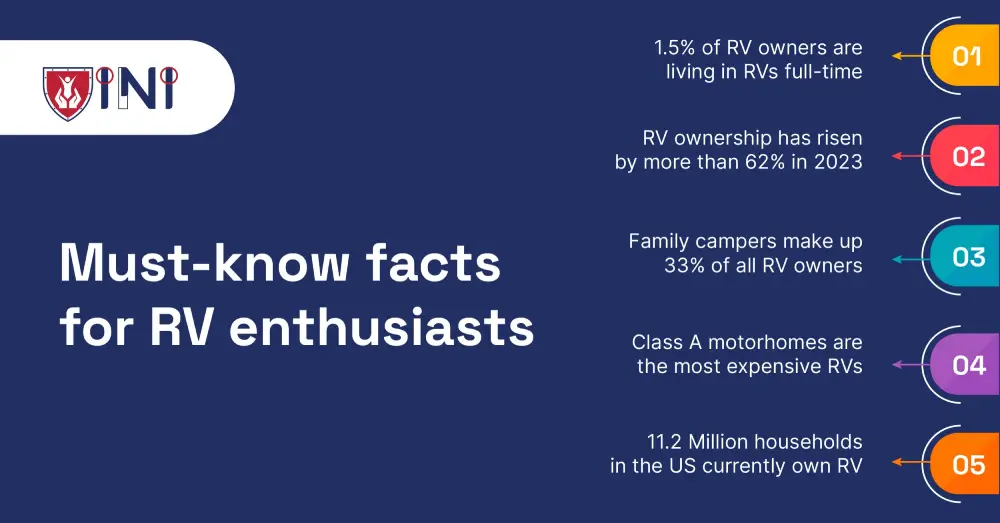

Stop worrying about finding hotels in Florida, when you have an RV! Watch those beautiful sunsets right from your vehicle. But, wait – Before you start your trip, don’t forget to get your Florida RV insurance.

Whether you’re a seasoned RV user or a newbie, in today’s blog, you will find different ways to secure the best RV insurance deals in Florida. Come, let’s hit the beautiful Floridian roads with the right and affordable insurance.

What is Florida RV insurance?

Florida mandates all motorists to carry RV insurance. Why? It’s because RV insurance in Florida protects you if you’re responsible for the damages caused to others.

It also helps in providing coverage for the total cost of damages caused to your vehicle when a covered incident occurs.

The 8 tips to get the best RV insurance Florida are all ready and up for grabs in the next section!

8 Tips for cheapest Florida RV insurance deals

This section is dedicated to all the individuals who have been tirelessly searching the internet for tips on finding affordable deals for camper insurance Florida

If that’s you, get ready to explore the cost-saving strategies and insights that will ensure your RV is not only road-ready but also financially protected on the Sunshine State's highways.

-

Get multiple quotes

We know you won’t settle for the first offer you receive. Spend some time collecting quotes from various insurance providers. This helps you to compare prices and coverage so that you have a wide range of options to decide.

Use online tools like the one from Indemnity National Insurance to get free quotes from different insurance providers.

-

Bundling insurance policies

You can utilize the option of bundling your RV insurance with other policies, such as auto or home insurance, as it can lead to significant savings.

Bundled coverage has the highest potential to attract discounts, helping you maximize your protection while minimizing costs. Consider bundling to get the best bang for your buck.

-

Check what others are saying

Consult with your fellow RV enthusiasts, and check for customer reviews online before getting your motorhome insurance Florida.

This can be valuable guidance in your decision-making process. Websites like BBB, Trustpilot, or RV forums can offer insights into the reputation and customer satisfaction of various insurers.

-

Take advantage of other discounts

Apart from bundle discounts, there are also other offers available for RV insurance. These may include safe driver discounts, multi-vehicle discounts, or even loyalty discounts for sticking with the same insurance provider.

Don't be hesitant – ask your insurer about potential discounts you might qualify for.

-

Assess your coverage needs

RVs are not the same, people customize the entire RV based on their travel plans. So, it is important to tailor your insurance coverage based on what you require. This prevents you from getting unwanted coverage.

If you're a full-time RVer, you might require different coverage compared to someone who only uses their RV seasonally. So, understand your needs and customize your policy accordingly.

-

Consider deductibles and premiums

You need to find the right balance between deductibles and premiums. While a higher deductible may lower your premium, it also means that you'll be paying more out of pocket in the event of a claim

So, before you choose a deductible, first assess your risk tolerance and financial situation to strike a balance that works for you.

-

Maintain a clean driving record

Your driving history is a main determining factor when insurers calculate your insurance premiums.

So maintaining a clean driving record benefits you in two ways. You get to stay safe on the road, plus keep your insurance costs within your affordability scale, translating to lower premiums – it's a win-win.

-

Review your policies and update

Your RV needs could be dynamic, and your insurance policy should be updated as per your RV lifestyle.

So, regular reviews are important so that you can update your coverage based on the changes in your RV usage, value, or any other relevant factors. This proactive approach ensures your insurance remains aligned with your evolving needs.

⚡Bonus tip - Understand Florida-specific requirements

Familiarize yourself with any state-specific insurance requirements in Florida for RVs, such as minimum liability coverage limits.

If you implement all the eight tips, we are sure you will be able to lock in the best RV insurance deals in Florida.

Now, let's look into Florida’s RV insurance requirementsyou need to be aware of.

Requirements of Florida RV insurance

If you own or rent an RV in Florida, as per the state’s requirement, you are supposed to carry liability coverage.

This means that you need to have the state’s minimum liability coverage, plus personal injury protection.

-

Property damage

Florida requires a minimum of $10,000 in liability coverage for property damage per accident.

This means that if you are found at fault in an accident, your insurance will cover up to $10,000 for the damage caused to the other party's property, such as their vehicle or other structures.

-

Personal Injury Protection (PIP)

In addition to property damage liability, Florida also requires $10,000 in personal injury protection (PIP) coverage.

PIP covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident.

This coverage is crucial for ensuring that you and your passengers have access to immediate medical assistance in the event of an accident.

These are state-mandated requirements, but RV insurance goes beyond that. Before delving into additional details of other coverages in the coming sections, let’s look at the top 5 reasons to get your RV insured in Florida.

5 reasons to get Florida RV insurance

All the adventures are meant to give a sense of thrill and excitement. But putting in a few dollars to an RV insurance can help you in the most unexpected ways. It helps you deal with the risks without breaking the bank! Let’s see why you need to protect your RV rides.

-

Protects against unforeseen events

With Florida’s unexpected weather conditions, it is always best to stay protected as there are various factors beyond your control.

Your RV insurance steps in to provide the protection you need. Whether it's damage to your RV or liability for injuries, your insurance is there to help you navigate through challenging situations.

-

Safeguards your investment

We know that your RV is not just a vehicle, it's an investment in your lifestyle and travel experiences. Without proper insurance, the financial impact of repairing or replacing your RV can be overwhelming.

Adequate coverage ensures that your investment is safeguarded, allowing you to enjoy the journey without constantly worrying about potential financial setbacks.

-

Provides liability coverage

Driving on the road comes with potential liability risks. If you accidentally cause damage to someone else's property or are involved in an accident where you're deemed responsible, the liability coverage comes to your rescue.

Without proper liability coverage, you could be facing significant financial and legal consequences. We don’t want that, right? So go ahead and get your free RV insurance quote from Indemnity National Insurance.

-

Zero hurdles in your journey

The last thing you want during your RV adventure is to be stuck dealing with the aftermath of an unforeseen event. Adequate insurance enables you to continue your journey without any major hurdles or unnecessary arguments with others on the road

Instead of being burdened with complications, you can focus on what matters most – enjoying your RV lifestyle to the fullest.

-

You get to tailor your coverage

You can customize your RV insurance in Florida based on how you use your RV, ensuring you have the specific coverage you need for your purposes. This way, you won't be lacking in the protection that matters most for your RV adventures.

Whether you're a full-time RVer or a seasonal explorer, you can customize your policy to align with your lifestyle and travel habits, ensuring that you have the right level of protection for your unique situation.

What are you waiting for? Before you get your RV engines up and running for the next adventure, make sure you have the right insurance coverage to explore and create memories on the roads of Florida.

Are you wondering if there are other RV insurance coverage options apart from property damage and personal injury protection?

Yes, scroll down to know!

Other Florida RV insurance coverages

Now, we are going to be talking about some of the other insurance coverage options that you can add to maximize the protection for you and your RV. Let’s see what these are:

-

Bodily injury and property damage liability coverage

While not mandatory in Florida, bodily injury coverage aids in covering the medical expenses of another person involved in a motor vehicle accident where you are at fault for their injuries.

Property damage liability coverage helps in paying for the repair or replacement of another person's property damaged in an accident where you are at fault.

-

Comprehensive and collision coverage

These coverages are commonly included in all travel trailer policies. Although not legally required in Florida, comprehensive and collision coverage are typically required by your lenders when you finance or lease a motorhome or travel trailer.

Comprehensive coverage addresses damages arising from events beyond your control, such as fire, theft, vandalism, glass breakage, weather-related issues, and collisions with animals.

Collision coverage may cover the costs of repairing or replacing your RV if it collides with objects like another vehicle, guardrail, or fence.

You should know that these coverages go beyond basic liability protection, providing comprehensive financial and physical protection for both you and your RV.

Again, there’s no compulsion to get all the coverage available. If you find it to be helpful, and you’re able to pay higher premiums, go the extra mile and get your additional RV insurance coverage.

What if you have a fleet of RVs, more than 5? Is regular RV insurance sufficient?

In a way, No! There’s something called commercial RV insurance. Come, let’s see who should get it.

Commercial RV insurance

This is a specialized insurance policy that provides coverage for liabilities, physical damages, and various situations related to the operation of a business involving the rental of recreational vehicles (RVs).

Commercial RV insurance is only for people who have rental RV businesses or in general for people who own more than 5 RVs. If you’re someone from the above category, it is a bit risky to have personal RV insurance.

So, who can get commercial RV insurance?

-

You have 5+ RVs and rent them out regularly.

-

You have an RV rental webiste.

-

Your RV is parked in a business location.

-

You manage a set of RVs that have been consigned to you by another business.

-

Your business employees or partners are driving your vehicles.

-

You use your RV for business purposes, such as a delivery vehicle and for expos.

If you fall under any of the above categories, it is safe for you to get commercial RV insurance rather than personal one as it provides coverage based on the commercial needs of your business.

What are the next steps?

Getting RV insurance in Florida is not as complicated as you think. You can talk to your insurance agent, apply for the insurance online, and customize your coverage.

Or if you prefer to send in a physical application, set up an appointment with your insurance provider and get your documents ready to apply for Florida RV insurance tailored to your location and circumstances.

No matter which avenue you choose, securing the right RV insurance is important. Use the 8 tips we shared, to get affordable, comprehensive, and tailored protection for your RV.

Get your free quote, no extra cost.

Did you find this article helpful? Share it!