Multiline Insurance: What does it mean & how does it work?

What is multiline insurance?

Multiline Insurance is one of the types of insurance policies that help provide coverage for different risks under a single agreement.

This is offered by many large insurance companies in the U.S. where different policies such as automobile, life, health, and homeowners insurance are combined into one policy.

Common examples of bundling insurance are auto insurance policies, homeowners insurance policies, business owner’s policies (BOPs), and commercial package policies (CPPs).

Next up, let’s see how you can benefit from multi-line insurance.

Benefits of multiline insurance

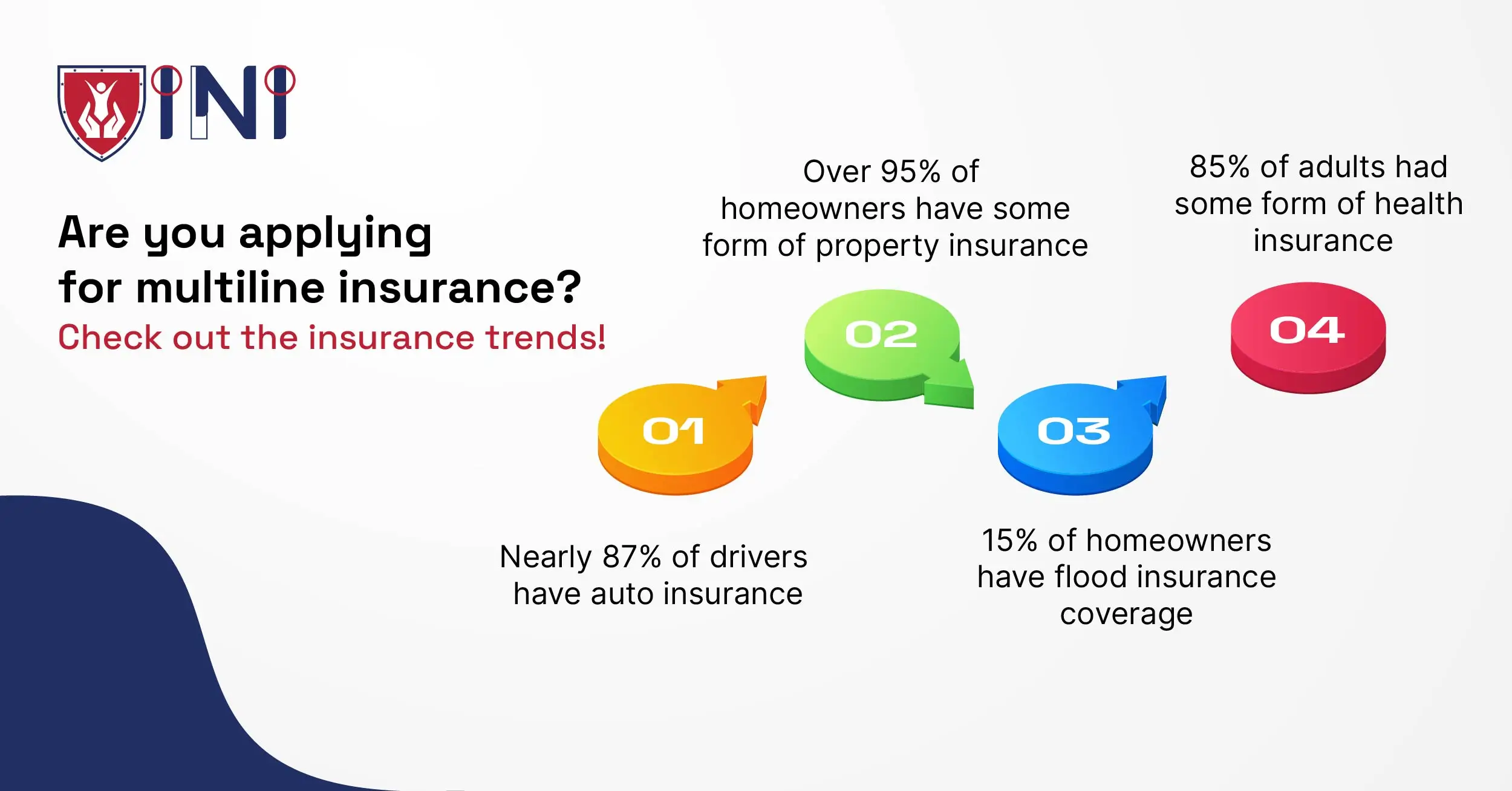

Did you know that individuals who bundle auto and home insurance save up to an average of 15% annually?

When it comes to benefits, bundled policies help both the policyholders as well as the insurance providers.

For policyholders -

-

You receive lower premiums

Combining home and auto insurance, among other coverages, often results in a lower premium, providing cost savings for the insured.

-

Aggregate deductibles

Here, deductibles are paid out of pocket as a lump sum before the company begins covering expenses for an individual family member.

This is popular because aggregate deductibles limit the total amount policyholders need to pay.

-

Avoids unnecessary paperwork

Dealing with a single insurance company serves as a one-stop shop for both businesses and individuals, streamlining the insurance process and enhancing convenience.

Think of it this way – You need not maintain individual paperwork for home insurance, auto, and health insurance separately.

-

Assess your risk together

Insured individuals and businesses benefit from presenting a complete risk profile to the insurer, ensuring a tailored and comprehensive coverage plan.

-

Improved customer service

Dealing with a single insurer translates to fewer interactions, fostering a likely better customer service experience for policyholders.

Consult with experts from Indemnity National Insurance and choose the right multiline insurance plan.

For insurance providers -

-

Provide multiple offers

Bundled insurance enables providers to offer a diverse range of coverages, attracting a broader client base and enhancing overall service offerings to their policyholders.

-

Improved client retention

When companies offer multiple offers, policyholders are likely to stay with the same insurance provider for a long time.

Hence, this increases the likelihood of client retention as policyholders are less likely to switch between providers when their needs are met all at once.

-

Reduced exposure to risk

Spreading risk across various factors minimizes financial burden in the event of catastrophic occurrences, providing a level of protection for the insurance provider.

-

Single billing

For insurance providers, the streamlined process of single billing helps administer the policy better while simplifying operational tasks, enhancing efficiency, and reducing administrative complexities.

By looking at these benefits, you might have realized by now that multi-line insurance emerges as a win-win solution.

This helps offer tailored coverage and streamlined processes for policyholders while providing insurers with a competitive edge and risk management advantages.

How does multiline insurance work?

Let’s understand this with the help of an example! If you buy car insurance, small business insurance, and home insurance from one company, the way every policy works would be different. To start with,

Car insurance

There’s nothing new as to how this works differently in multi line insurance. It works pretty much the same as every other car insurance policy.

The coverage you receive will include bodily injury, and property damage liability insurance along with the comprehensive and collision coverage.

Here, your liability car insurance will help pay any property damage and injuries caused by you to others in accidents where you’re at fault.

Comprehensive and collision coverage helps pay for repairs or replacement of your vehicle, if it’s stolen or damaged by a covered accident.

Some of the covered accidents could be theft, collisions, and non-crash events like fire, flooding, vandalism, etc. We will now talk about how your home insurance might work.

Home insurance

Apart from other useful coverage types, every home insurance policy will have 2 main types of coverage, they are:

-

Dwelling coverage

They cover the costs of rebuilding and repair of the physical structure when damaged by a covered hazard.

-

Liability coverage

They help address accidental injuries and property damage caused by you or your household members. Additionally, it covers legal expenses, settlements, and lawsuit judgments if you are sued, up to your policy limits.

Let’s see what you get from small business insurance policies.

Small business insurance

99.9% of businesses in the U.S. are small businesses. To protect all the important business assets, there is one common and popular type called business owners policy (BOP).

Three main types of business owners policy are:

-

Business interruption insurance

When a covered problem occurs, this coverage steps in and replaces the income you lost. This helps you to continue your business operations without spending extra money.

-

Commercial property insurance

What do you do when the physical assets are damaged, lost, or stolen? How will you continue with the work?

If you have commercial property insurance, you can fix them all without any hassles.

-

General liability insurance

They provide compensation for a range of claims against you. Especially when you cause bodily injury or property damage to others.

In multiline discount insurance, when an issue arises, you can claim the specific coverage from any of your combined policies. Getting multiple insurance policies can be highly beneficial especially if you meet with two uncertainties at once. It would be easier to claim and process.

Bundling car insurance with other policies is beneficial, especially if you have a poor credit score. So let’s check how you can get no credit check cars insurance with the help of bundled insurance.

How to get no credit check cars insurance?

We know that some of your credit scores are not the best, and it’s okay! With the job market fluctuating, most of you might find it challenging to maintain your credit scores and your credit history.

But, we are here with a bunch of solutions to help you get a no credit check cars insurance:

If you live in a state that permits insurers to skip the assessment of credit reports, you get to avoid a credit check.

Try to get a usage-based insurance policy. It’s simple! Here your monthly premiums are based on the total distance you drive within a specified period.

The premiums are not fixed. Insurers use telematics to track your driving habits. This way, you can get your cars insured with a no credit check cars insurance.

These methods can be your last resort if nothing works. But, why do insurers from most of the states require your credit scores? Aren’t you curious? We’ll clear that up for you.

How does credit score impact insurance rates?

Credit scores play a significant role in determining car insurance rates as they indicate your likelihood of paying the insurance claims. Although they’re not the main determining factor, it’s good to have those three-digit numbers right on track.

According to Nick Schrader, an insurance agent with Texas General Insurance, there is a strong correlation between drivers with poor credit and an increased probability of filing higher-than-usual insurance claims.

Poor credit may also be associated with a higher likelihood of missed payments or lapses in insurance coverage.

When drivers with poor credit fail to pay premiums or file claims, it results in financial losses for insurance companies. That’s the main reason they ask you “What’s your credit score?” before starting the application process.

In response to these potential risks, most car insurance providers adjust rates, charging higher premiums for drivers with poor credit and lower premiums for those with good credit.

So, it’s important to get those credit scores optimized so you don’t have to get a no credit check for car insurance. So, grab a few tips to get your credit score to go from poor to good.

4 ways to improve your credit score

We know what you’re thinking – Why go for other options when there is a way to get no credit car insurance?

The process is not as simple as you think. You might have to go through a lot of background checks to prove your creditworthiness. So, why extra work? Use these simple tips below to improve your credit scores:

-

Credit report check

Fill in your details and download your credit report from major credit bureaus (Equifax, Experian, TransUnion).

Check if there are any inaccuracies, discrepancies, or unauthorized accounts. If you find any, get it corrected immediately.

-

Make timely payments

Paying your bills on time can help you in unexpected ways. Missed or late payments can affect your credit score drastically.

Focus on reducing outstanding debts, particularly high-interest ones. Develop a strategic plan to pay off debts systematically, starting with those with the highest interest rates.

-

Maintain your credit limits

Never go beyond or up to the maximum credit limit. Based on the limit offered to you, plan your purchases accordingly so that your credit utilization ratio is lower.

You can also consider spreading balances across multiple cards rather than maxing out a single card.

-

Have a credit mix

A healthy credit mix, including credit cards, installment loans, and retail accounts, can positively influence your credit score.

Be cautious about opening new credit accounts one after the other, as this can temporarily lower your score.

Also, make sure you prioritize managing existing accounts responsibly before considering new credit.

By implementing these strategies, you can gradually improve your credit score over time, and reduce the need for looking at options such as no credit check cars insurance.

Is multiline insurance for you?

Absolutely, you can go for it. If you want to manage all the insurance policies and risks in one single policy, multi line insurance can benefit you in multiple ways.

Also if you want to lower your insurance premiums, this one’s the best option! However, individual needs vary, and it's crucial to weigh the advantages against your specific requirements.

Consider factors like your lifestyle, the assets you want to protect, and your budgetary constraints.

Multi-line insurance, with its potential for cost savings and streamlined management, might be an ideal fit for those seeking convenience and comprehensive protection.

On the other hand, if customization and flexibility are important to you, individual policies tailored to specific needs might be more suitable.

So, evaluate your priorities, explore various policy options, and consult with insurance professionals to determine whether multi-line insurance aligns with your unique circumstances.

Save time & money 👉 Get started

Did you find this article helpful? Share it!