Louisiana's Best Mobile Homeowners Insurance for 2024

Mobile home insurance: What you need to know?

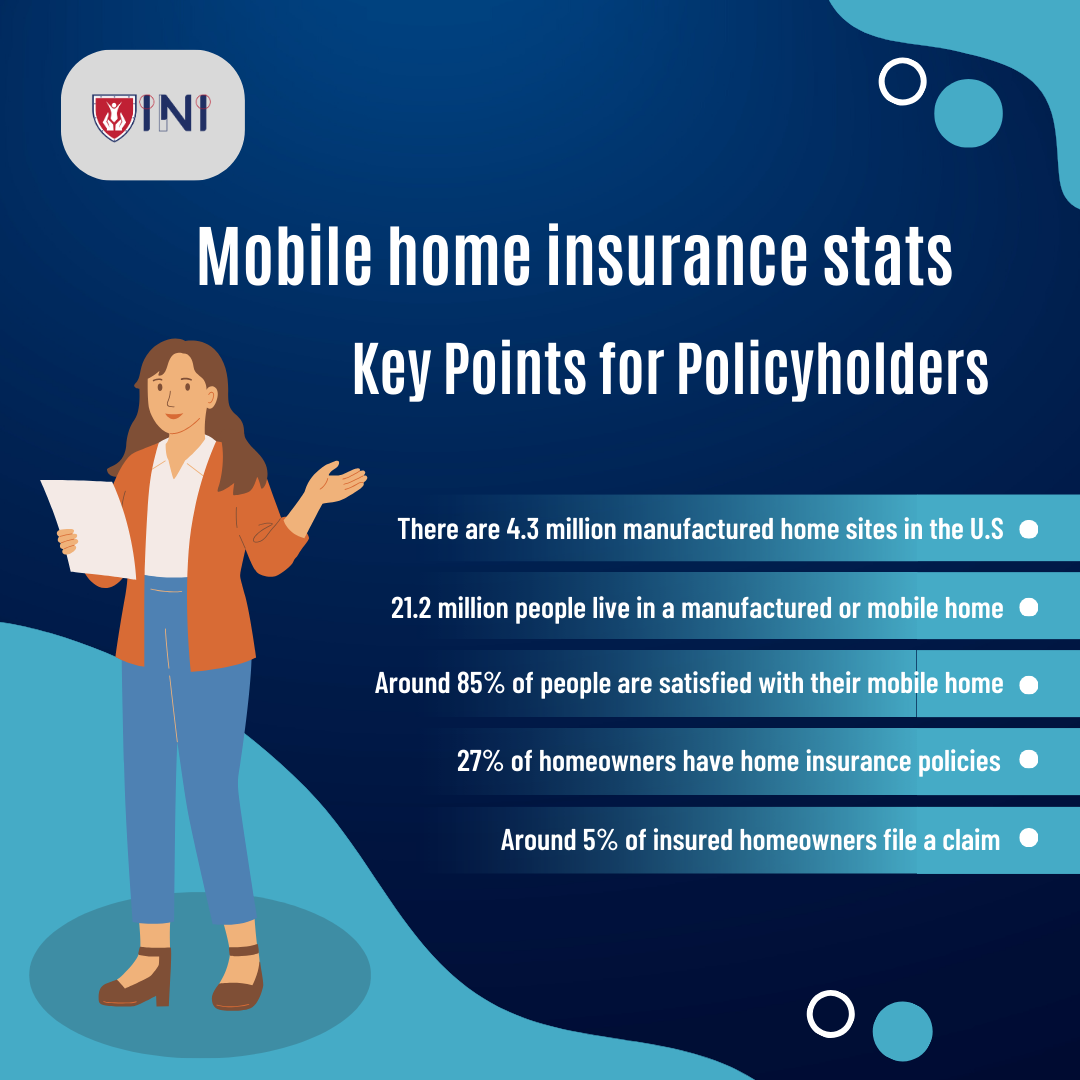

Mobile homes are also referred to as manufactured homes and they are regulated by the U.S. Department of Housing and Urban Development. They have their own standardized parts and are assembled in a factory.

Let’s now explore some of our top picks for mobile home insurance in Louisiana.

Louisiana’s best mobile home insurance 2024

If you’ve been laid back from getting home insurance for your mobile home due to an added cost, don’t worry! We have done the extra work for you so you can save some time doing your research. Here are our top picks for you 👇

| Providers | Features | Average Annual Costs |

|---|---|---|

| Progressive | They have the best average home insurance rates | $1,157 |

| USAA | Works best for people in the military. They offer low prices | $3,745 |

| Allstate | They are known for their extended coverage | $4,826 |

| State Farm | Best for first time homeowners | $1,460 |

| Shelter | Excellent for extended coverage options | $4,345 |

Apart from these top picks, there are other insurance companies as well. You can select the one that serves best for you based on your affordability and preferences.

Before you select a coverage option, you need to know if all the essential coverage has been provided to you, right? Keep scrolling through the blog to know what needs to go in your mobile home insurance Louisiana.

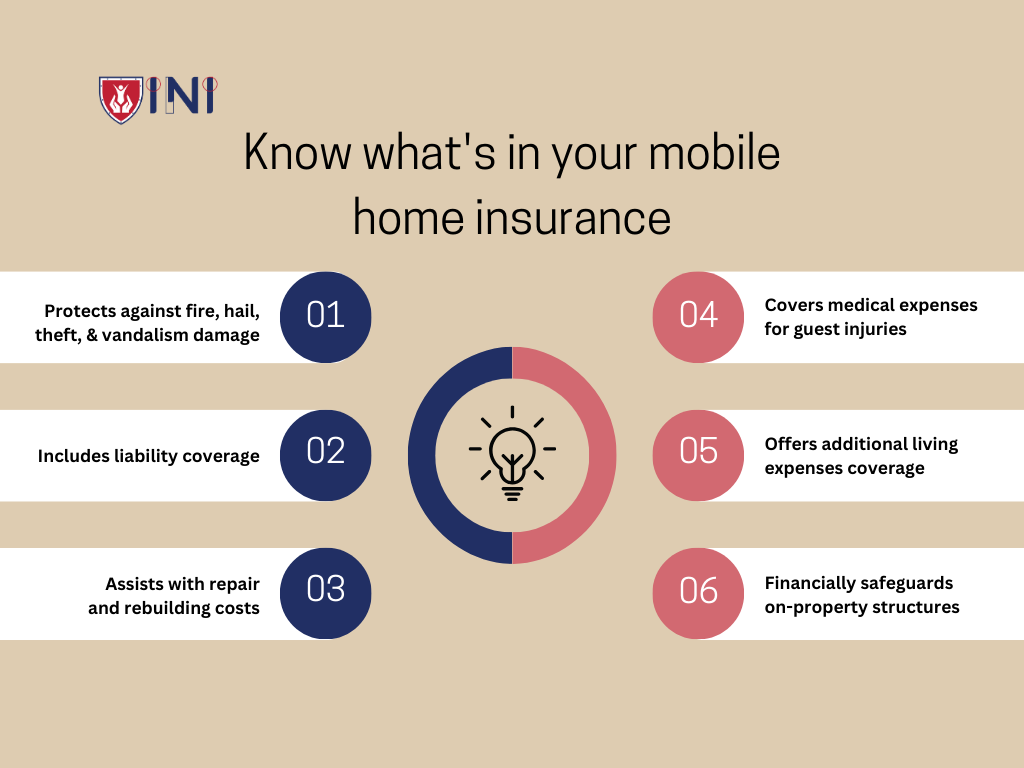

What does mobile home insurance cover?

Mobile home insurance is kind of like regular homeowners insurance but tailored for mobile homes. It protects your home, your stuff inside, and covers you if someone gets hurt on your property.

There are six main parts to Louisiana mobile home insurance. Let’s have a closer look at what each of these means to mobile homeowners like you.

-

Physical damage

Simply put, if something happens to your mobile home, like damage from a fire, hail, theft, or vandalism, a mobile home insurance policy usually takes care of the costs to fix or replace things.

This includes not just your home but also other structures like a patio or garage, and even your personal stuff inside.

However, some policies only cover specific reasons for the damage, known as "named perils." These policies might cost less, but it's essential to talk to your agent to know exactly what's included and what's not, so you're not caught off guard.

-

Personal liability

Let’s say, someone in your house accidentally damages someone else's property, or if a friend gets hurt while at your place.

Liability coverage acts as a safety net, but here's the catch: if you or someone in your house gets injured, the insurance won't cover the medical bills. So, if you slip on your steps, you're on your own for the medical expenses.

But, if your kids, for example, accidentally break the neighbor's property while playing, the insurance should step in and cover the cost of fixing it up.

-

Dwelling coverage

It pays for the repairs or, in severe cases, the complete rebuilding of your house. It's not just about the main structure; dwelling coverage also extends to things connected to your home.

This includes attached structures like a garage, porch, or deck. So, if your garage gets damaged along with your house, the insurance helps cover the costs of fixing it.

However, it's crucial to be aware of policy limits. The insurance will provide coverage up to a certain limit specified in your policy. If the repair or rebuilding costs exceed this limit, you might need additional coverage or need to cover the excess costs yourself.

-

Medical payments

Medical payments to others are an additional feature in your insurance that takes care of smaller medical bills from people who don't live in your home.

So, if a friend or someone else visiting your place gets hurt, whether or not it's your fault or theirs, this coverage helps out with their medical expenses.

-

Additional living expenses

If your house is affected by a natural calamity or if your kitchen is destroyed by a fire accident and you’re unable to live in your home, additional living expenses coverage steps in to help you find a temporary place to stay and covers the costs of meals and services you need while your home is being repaired or rebuilt.

-

Other structures

This is designed to financially protect structures on your property that are not directly attached to your main dwelling.

These can include things like a fence, an in-ground swimming pool, a detached shed, or any other structures that are separate from your actual home.

These are the standard coverage options provided by most Louisiana mobile home insurance providers.

If you want to protect specific spaces within your mobile homes, it is best to get a personalized quote from Indemnity National Insurance. No hidden fees, or spamming emails involved! Click here 👉 and get your free mobile home insurance quote.

So far we’ve been looking at mobile home insurance options for newly built or renovated mobile homes. But what about insurance for older mobile homes? Are the premium amounts higher? What kind of coverage options are available?

To get all the answers you need, hop on to the next section!

How can you get older mobile home insurance?

It is quite challenging to find insurance options for older mobile homes, isn’t it? Particularly those built before 1976. This is usually the case because older mobile homes come with outdated systems and manufacturing standards.

But it is still possible to get your older mobile homes insured and that too with minimum insurance costs. Here’s how:

-

Adjust your coverage

Pick your own fruits as much as you need. Never overpick! If you need to save money, you can choose a bit less coverage, but make sure it's still enough in case something happens and you need to make a claim.

-

Improve your credit health

Credit reports are always used by insurance companies to check how good you are at managing money. If you make payments on time and utilize the amount within the limit, you can lower your insurance costs.

-

Raise your deductibles

If you agree to pay more deductible, you will be offered lower premiums. But, if you can’t manage to pay heavy deductibles, then you might have to pay slightly higher premium amounts.

The choice is yours, but increasing them can get you the best mobile home insurance in Louisiana.

These are a few tricks that we think can help you save hundreds of extra dollars on your older mobile home insurance. Do you know why we said that?

This is because the average cost of mobile home insurance ranges between $300 to $1000 each year. So, if you implement these tips above, we are sure you can find affordable older mobile home insurance.

Also, you can get some amazing discounts. Let’s see if you qualify for them.

Discounts on older mobile homes

Discounts are everyone’s favorite, right? Here is a list of common discounts offered by insurance providers.

-

Location

You can use those discount points and save more if your mobile home is located in a mobile home park.

-

Safety measures

Installing mobile home safety systems can get you discounts for maintaining safety standards.

-

Age

Are you a mobile homeowner aged 50 years or older? If so, you can earn discounts based on your age.

-

Continuous coverage

If you have been taking care of your older mobile home by getting insurance coverage every year, you can earn those additional savings.

-

Free from claims

If you haven’t filed a claim for a long time, your insurance provider will reward you with cheaper premiums as you might be considered a lower-risk policyholder.

These are some of the common discounts available, but other discounts such as bundling policies, auto-pay, installation of a new roof, and nonsmoker offers, are applicable based on your situation.

It is wise to check with your insurance provider before finalizing your documents. Some of the major companies that provide insurance for older mobile homes are – American Family, Assurant, Allstate, Foremost, American Modern, and State Farm.

Is mobile home insurance worth it?

Without a doubt, it is a biggg YES! As you’re residing in a mobile home, you get to save on taxes, and other hefty home maintenance costs that you would otherwise spend if you lived in a traditional home.

Now that you’re eliminating all those costs, investing in mobile home insurance is a smart as well as a safe choice. In case something happens to your mobile home, you can replace your mobile home just like how it looked before the damage without incurring any extra cost.

Remember, that the cost of insurance is a small price to pay for the invaluable protection and security it provides. Mobile home insurance is not just worth it, it's an essential step in ensuring a worry-free and financially protected future for you and your home.

So go ahead and get your mobile home insurance now.

Enter your Zip Code & choose your plan

Did you find this article helpful? Share it!