Whole Life Insurance vs. Indexed Universal

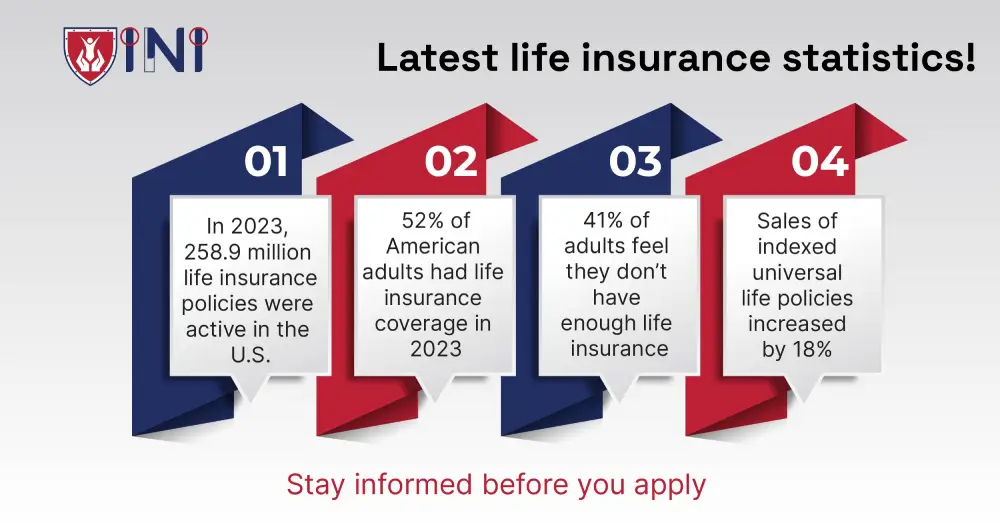

We’re gonna be honest with you! The concept of indexed universal life insurance is permanent, to a certain extent similar to your whole life insurance policies. People think IUL is a way to access cash value while alive.

But, the reality may not match the hype. In today’s blog, you will learn why. We will dive deep into the advantages and complexities of indexed universal life insurance, guaranteed universal life insurance, and whole life insurance.

Indexed universal life insurance: Explained

If you’re thinking, what's the big difference between a whole life insurance vs indexed universal life insurance policy? It all lies in the way your cash value is accumulated.

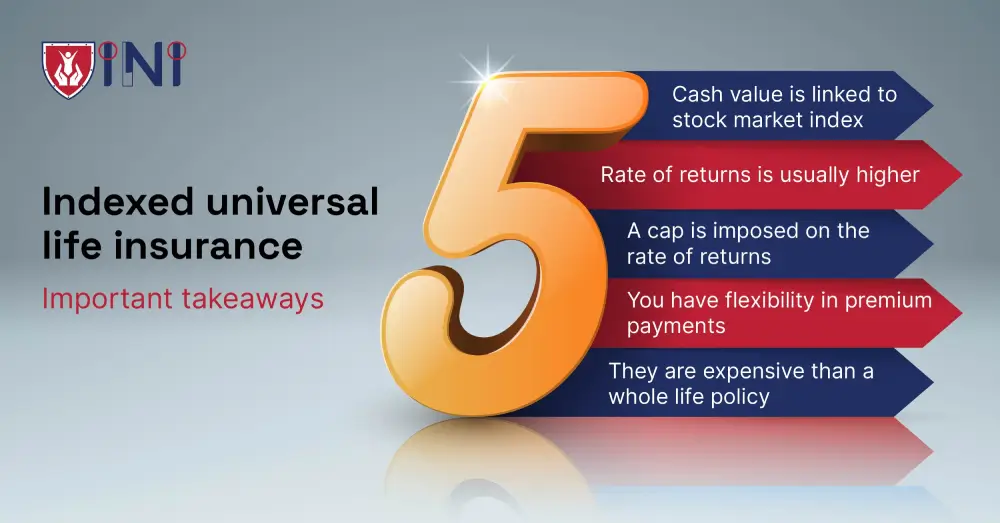

The indexed universal life insurance policy’s cash value is tied to a stock market index’s performance.

Features of indexed universal life insurance

If you look closely, the cash value of the whole life insurance policy grows based on a fixed interest rate. You can take out loans against the cash value from both policies.

-

If you take out an indexed universal life insurance, you need to understand the rate of return and the rate at which your cash value accumulates.

-

Unlike the whole life insurance policies, the cash value doesn’t get accumulated based on your premium payments.

-

In indexed universal life insurance, your cash value is accumulated based on how the underlying stock market index is performing. These indexes track a particular sector or segment of the market.

-

People often go for an IUL, due to its return potential as it can be higher than whole life insurance. But, the returns are not unlimited. There will be a cap rate imposed by insurance companies, limiting the returns you get each year.

-

Certain insurance companies will offer you a minimum guaranteed rate of return, and you might have a cap rate of 3 or 4% annually. This certainly differs based on the insurance company you choose.

Let’s have a quick look through the breakdown of the benefits and drawbacks of IUL below.

3 pros and cons of indexed universal life insurance

Let’s see why a certain group of individuals prefer to get indexed universal life insurance, while others opt for other forms of life insurance policies.

Pros-

You can potentially earn higher interest rates.

If your cash value increases, the death benefit you receive can go up.

You have flexibility in paying the premiums.

Cons-

The premiums can go up if the interest rates change.

They are a bit expensive compared to whole life insurance.

It might be challenging for you to understand the policy and the underlying index.

Indexed universal life insurance can be a great choice. It gives you better returns and flexibility.

But, here's the thing, you've got to consider the downsides too. If dealing with complexities isn't your cup of tea, maybe check out some other options. It's all about finding what suits you best!

To help you with that, let’s see some of the key differences between whole life insurance vs indexed universal life.

Whole life insurance vs indexed universal life

As we touched upon both these concepts initially, there are still some key distinctions that set indexed universal life vs whole life policies apart. Let’s see how they are different from each other.

| Whole life insurance | Indexed universal life |

|---|---|

| 1) They are mainly focused on providing guaranteed death benefits to policyholder’s beneficiaries. | 1) More than guaranteed death benefits, indexed universal life insurance focuses on accumulating cash value based on stock market index performance. |

| 2) Their premiums are fixed and don’t increase as the policyholder’s age goes up. | 2) They give policyholders an option to set aside all or a portion of their net premium to a dedicated cash account. |

| 3) Here, you have the option to pay your face value in 10, 20 years, or at the age of 65. | 3) Their earnings potential is tied to an equity index and hence they are a bit complex and riskier. |

| 4) If needed, whole life insurance also offers you the option to borrow against the cash value if you need it later in life. | 4) So, if you’re expecting a return on your accumulated cash value, there is a limit on the returns you get each year. |

| 5) The best thing about whole life insurance is that the cash disbursements and interests can be free from income tax. | 5) In case there’s a fall in the stock market index, your returns will be impacted. |

| 6) The interest rates may not be guaranteed, and there will be a minimum floor rate set by your insurance provider. | 6) Due to the flexibility offered in premium payments, there is a potential for them to grow over time based on a lot of factors like economic conditions and the stock market index performance. |

| 7) Premiums need to be paid without a pause and if you’re expecting flexibility, whole life insurance isn’t the one for you. | 7) Even if there is a potential for you to earn higher interest rates, the earnings depend on the performance of your equity. |

This breakdown highlights only the key differences between whole life insurance vs indexed universal life policies.

Ask yourself, do you need a guaranteed death benefit or an investment opportunity by tapping into the cash value accumulation?

No matter what you choose, while you decide between the indexed universal life vs whole life policy make sure to have an open approach.

Understand the implications and complexities of both life insurance types and then decide. Remember, the main goal of getting life insurance is to protect your family when you’re there for them.

Okay, now that we’ve tackled the basics of whole life insurance vs indexed universal life insurance, it’s time to expand our knowledge. In the coming sections, you will learn more about one more insurance option – guaranteed universal life insurance.

Get ready as it’s always good to have options!

What is guaranteed universal life insurance?

As the name goes by the term “guaranteed”, in your guaranteed universal life policy, death benefits are guaranteed and your premiums are fixed.

-

If you’re looking for an affordable life insurance option and guaranteed coverage for the rest of your life, guaranteed universal life insurance might be an appropriate option for you.

-

In addition to that, you can also tailor your policy’s premium payments and the schedule of paying the premiums according to your needs.

-

But, you might not get the cash value in a guaranteed universal life policy. Even if you do, it will be limited and not as big as your whole life insurance or indexed universal life insurance.

-

There's a right balance between term and permanent life insurance that most consumers find cost-effective.

-

Want to know how guaranteed universal life insurance is cost-effective? Get a personalized quote from Indemnity National Insurance here.

-

You can also get a return of premium rider that will refund your premiums if the policy has been canceled.

If you have been planning to get whole life insurance, just hold on and stick around as we are about to see the difference between a whole life policy and guaranteed universal life insurance.

Whole vs guaranteed universal life insurance

Are you focused on building cash value or do you require permanent coverage and a guaranteed death benefit? Go through the table to find out!

| Policy feature | Whole life insurance | Guaranteed universal life insurance |

|---|---|---|

| Premiums | It stays the same for life, but the younger you are, the lower the rates will be. | They also don’t have fluctuating premiums. But, you need to make the premium payments on time. |

| Cash value accumulation | It is applicable but usually accumulates at a fixed rate. | They have a minimal cash value growth, as the focus is to offer maximum coverage and death benefits. |

| Investment opportunities | It plays it safe with investments, ensuring steady but not flashy returns. | No opportunities to invest, as the cash value growth is very low. |

| Who is it for? | Individuals who prioritize estate planning or leaving an inheritance. | Individuals who need a permanent guarantee of death benefit along with lifelong coverage. |

You can now use these policy features as a base to compare all your life insurance policies and select the right coverage based on your needs.

Get your guaranteed universal life insurance quote from Indemnity National Insurance and compare different coverage options, to secure your family’s needs.

Got your quote? Also, don’t forget to grab the bonus of today’s blog below.

3 tips to select the right policy

Whether you choose a whole life, indexed universal, or guaranteed universal life insurance policy, having the right balance between comprehensive coverage and affordability is key.

So here are some valuable bonus tips to guide you through the process:

-

Consult with a qualified insurance advisor

Making decisions about insurance all by yourself can be complex, and that's where insurance experts come in. We know there are fancy advertisements everywhere. But look for a legitimate insurance advisor.

They can clarify complexities and ensure that the chosen coverage aligns seamlessly with your needs.

-

Understanding your policy details

The devil is in the details, they say – and that couldn't be truer for insurance policies. Don't be tempted to skim through the terms and conditions, take the time to thoroughly understand them.

Pay attention to the coverage limits, exclusions, and any conditions that may impact the benefits of your whole life, indexed universal life, and guaranteed universal life policy.

If there's something you don't understand, don't hesitate to seek clarification from the insurance provider or your financial advisor.

-

Compare quotes

Insurance is a highly competitive market, and different providers may offer varied terms, conditions, and benefits for similar coverage.

Don't go in with the first quote you receive. Take the time to shop around and compare quotes from reputable insurance providers.

Consider factors such as premium costs, coverage limits, and any additional benefits offered. This can help you save money and ensure you get the best value for your investment.

Wasn’t that a quick read? Don’t fall for attractive advertisements that guarantee you different benefits and higher returns on cash value. Know what matters to you, and then choose a policy on that basis.

What’s the best choice: Whole Life or Indexed?

While Indexed Universal Life (IUL) may seem like a golden ticket to accessing cash value while alive, the reality check is in. Sure, it has its perks, but there's a lot more to it.

If you’re ready to face the complexities, you can start getting IUL. But, consider the benefits of whole life insurance as it sticks to a fixed interest rate.

Indexed universal insurance ties your cash value returns to the stock market's performance. Be aware of flashy promises, and ensure your choice aligns with what truly matters to you.

Remember, the goal of life insurance is to provide a safety net for your loved ones when you're not around. Read our blogs on life insurance to stay informed, and protected.

Get a quote to your inbox in 5 Mins

Did you find this article helpful? Share it!